By Ramsey Solutions

How to Create an Employee Compensation Plan

Picture yourself sitting on the white sandy beaches of your dream vacation. You dig your toes into the sand while waves roll onto shore. Life’s pretty good thanks to a little paid time off.

Yep, paid time off (PTO) is a pretty great employee benefit. But for most companies, PTO is just one piece of the overall compensation plan.

A great employee compensation plan does three things:

- Attracts the talent you need to fill your open positions

- Motivates your current team to do great work

- Keeps your company profitable

That’s a tall order lots of companies struggle with. So, let’s dig into the ins and outs of how to create an employee compensation plan and our advice for building one that’ll work for your company.

What Is a Compensation Plan?

A compensation plan is how a business takes care of its most important assets—its employees. It’s a combination of a company’s wage structure and additional benefits, like health insurance and financial wellness benefits.

A good compensation plan helps retain employees and attract new talent.

What’s Included in a Compensation Plan?

For potential employees, the compensation plan is the make-or-break standard—if you don’t offer enough benefits or the benefits you have don’t appeal to them, they may take another company’s job offer instead of yours.

Here are some key components of compensation plans:

- Wages and salaries

- Annual bonuses

- Health insurance

- Life insurance

- Dental insurance

- Disability insurance

- PTO

- Incentives

- Profit sharing

- Retirement savings accounts, like a 401(k) match

- Fringe benefits (financial wellness benefits, fitness reimbursements, grocery membership reimbursements, etc.)

Just as a detailed compensation plan can attract the best applicants, it can also serve as a retention and motivational strategy for your employees. With great benefits—like a 401(k) match, profit sharing and other fringe benefits—you make it easier for your employees to stay because they appreciate the compensation plan.

Direct and Indirect Compensation

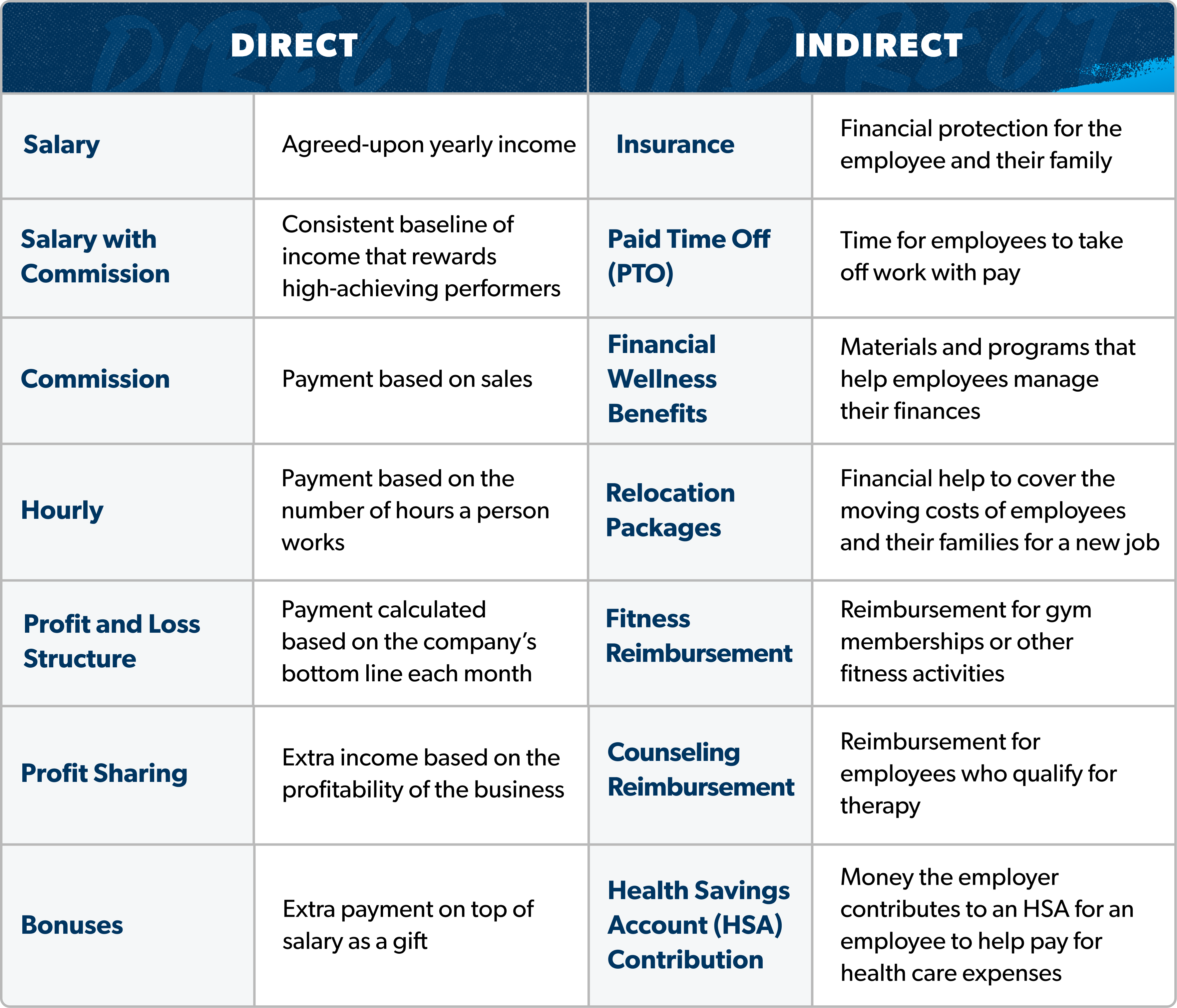

There are two main types of compensation: direct and indirect. Direct compensation is money you pay an employee for the work they do. That pay includes salaries, wages and bonuses.

Indirect compensation includes fringe benefits and other parts of a compensation plan that don’t directly affect an employee’s income. Think of things like insurance, PTO, financial wellness benefits like SmartDollar, relocation packages, fitness benefits and more.

Employee Classifications

Before you start creating a compensation plan, you need to take a look at employee classifications. Most people are familiar with salary and hourly jobs, but there’s another classification called exempt and nonexempt.

Exempt means employees can’t work overtime. Nonexempt means employees can work overtime for additional pay.

Overtime isn’t only for hourly workers, it’s for salaried workers too, unless the employee meets the exempt criteria established by the U.S. Department of Labor. They outline the exemption at a minimum salary of $684 per week, as well as additional criteria for specific positions.1

Roles and Pay Types

Typically, certain jobs are associated with types of pay (salary, hourly, commission, etc.). As you develop your compensation packages, learn from the current market.

Most sales jobs offer compensation through commission. Employees get paid for their sales, calls and leads. Their income is one of the top lines of a company’s budget. Take care of your sales teams and they’ll take care of you.

Although commissioned pay is great for sales, this kind of pay isn’t realistic for every position. So, for indirect revenue roles (aka supporting roles like administrative assistants, designers and developers), offer a salary, or an hourly rate when appropriate. A salary or hourly wage pays employees what they’re worth. Since you can’t always determine the impact on sales and business growth with these employees, a salary or hourly wage says you know your company wouldn’t get sales without them.

When it comes to other department leadership roles, Ramsey Solutions offers a base pay with commission off the bottom line. The additional commission for these department leaders keeps them involved with their team since they get a slice of the pie when the team is successful. It’s a great motivational and engagement tool for leadership.

What Are Leadership Styles vs. Leadership Principles?

Leadership styles and leadership principles are simply terms that refer to how you lead and why you lead that way. A leadership style is how you interact with your employees in the day-to-day work. It defines how your employees expect you to behave and the type of relationship you have with them.

Leadership principles are the why behind your style. These principles, like open communication, trust or company values, are the things you believe in as a leader and take with you to every job and meeting. They’re the foundation of your leadership style—and that means you need to be crystal clear on your values and principles before you start leading people.

If all that feels a little cloudy, don’t worry. You’ll see how styles and principles work together as we look at three common leadership styles, what they are, and how they affect your employees and business.

3 Steps to Create Your Compensation Plan

Whew! That’s a lot of information. But now that we’ve got the nuts and bolts of compensation plans covered, let’s talk about how you can use them to create a compensation plan for your company.

Step 1: Identify your company’s business and hiring values.

First, you need to figure out your compensation values. These values are rooted in your company’s identity—how you conduct business and how you hire.

Here at Ramsey Solutions, we use our core values to guide us through everything, especially compensation. Two of our core values are Profit Sharing and Self-Employed Mentality. Our team members share the struggles and successes of the company with profit sharing. In turn, they take more ownership of their job (self-employed mentality), which helps them find unique solutions to business problems.

Step 2: Outline your positions with accurate job descriptions.

From the outside looking in, job descriptions are the first impression of a company. But behind the help wanted ad is a company setting their priorities.

A job description helps you create a compensation plan in two ways:

- It documents the roles your company needs to fill.

- It informs your compensation research (more on that later).

As your business grows, you know you need more people, but who do you need? Figuring out all the positions you need helps you prioritize which roles to fill first to make sure you can afford to pay those hires.

Hiring needed talent and what you can afford to pay them is a delicate balance. If you rush the hiring process, you run the risk of causing an imbalance and hurting the company and employees long term. For example, too much hiring and low profits often lead to layoffs, which hurts everyone.

Step 3: Conduct market research on compensation packages for each position.

A good compensation plan is a continuous conversation with the marketplace. If you stop having that conversation, you’ll get left behind. That’s right. Conducting market research is the best way to stay on top of your compensation packages for each position.

During your research, pay close attention to business trends, hiring freezes, nationwide layoffs, inflation, real estate markets, and your local economy. Compensation isn’t a one-size-fits-all package. You need to do what’s best for your company, in the area you live, while addressing your hiring needs.

A Compensation Plan Is a Win-Win for You and Your Employees

The best deals in business are those where both sides love what they get out of the deal. You and your employees should feel the same way about your compensation plans.

Every well thought out compensation plan balances the cost to the employer with the benefits to the employee. So, while they’re on vacation sipping on a mai tai, you know they’ll come back (some day).

Listen to your employees and talk with them regularly to learn how you can improve your compensation plan over the years. Two-way communication will save your company and improve retention.

About the Author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.